Condo Insurance in and around Channelview

Townhome owners of Channelview, State Farm has you covered.

Cover your home, wisely

Calling All Condo Unitowners!

When it's time to relax, the home that comes to mind for you and your family and friendsis your condo.

Townhome owners of Channelview, State Farm has you covered.

Cover your home, wisely

Agent Pete Dever, At Your Service

You want to protect that meaningful place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as vehicles, weight of ice or snow or lightning. Agent Pete Dever can help you figure out how much of this great coverage you need and create a policy that works for you.

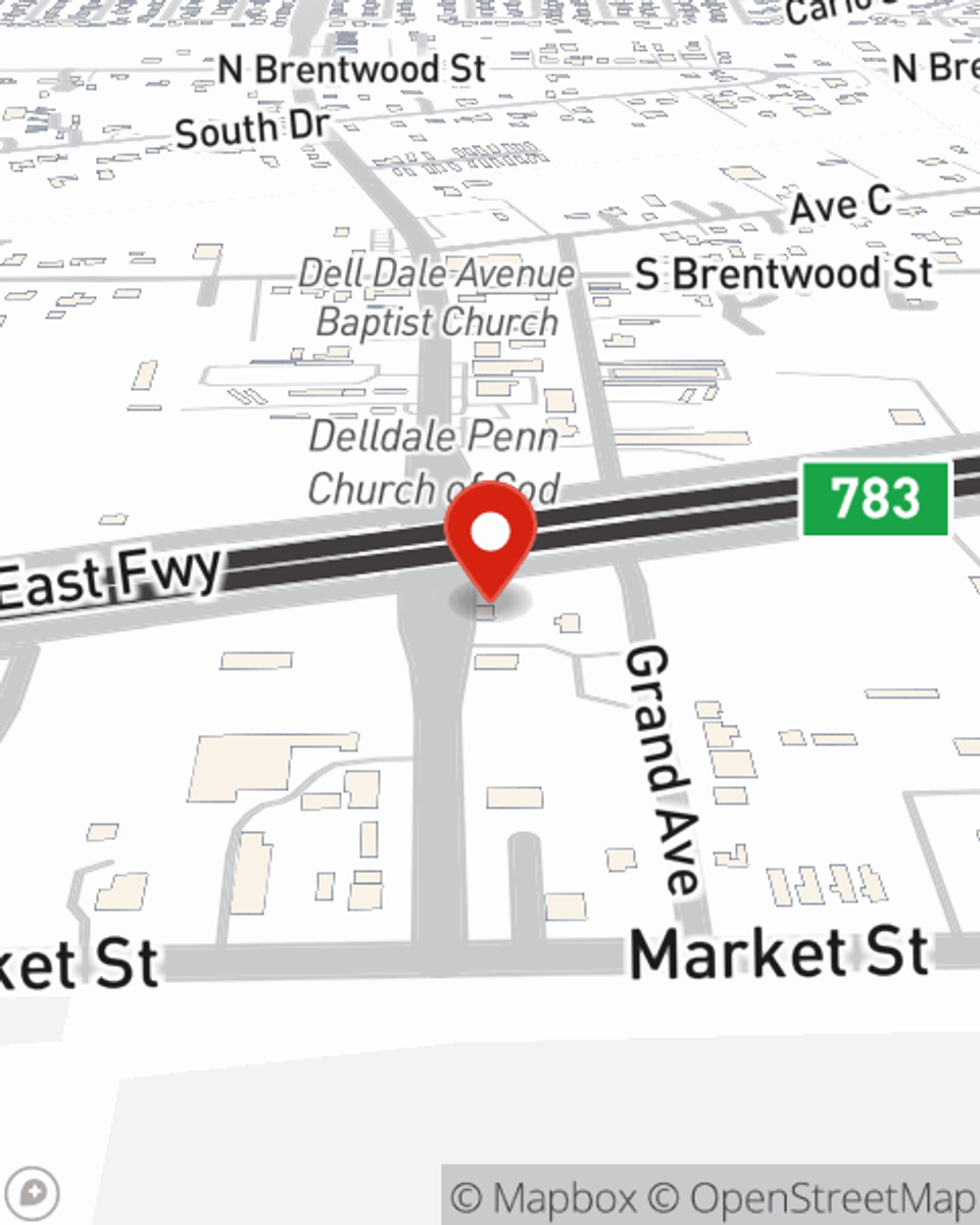

When your Channelview, TX, condominium is insured by State Farm, even if the unexpected happens, State Farm can help guard your property! Call or go online today and see how State Farm agent Pete Dever can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Pete at (281) 452-1563 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.